Financial Services and Insurance

Use AI solutions from Cleanlab to ensure high-quality data and models are used in key processes like: fraud detection, customer interaction, or risk assessment.

Case StudyBanco Bilbao Vizcaya Argentaria (BBVA)

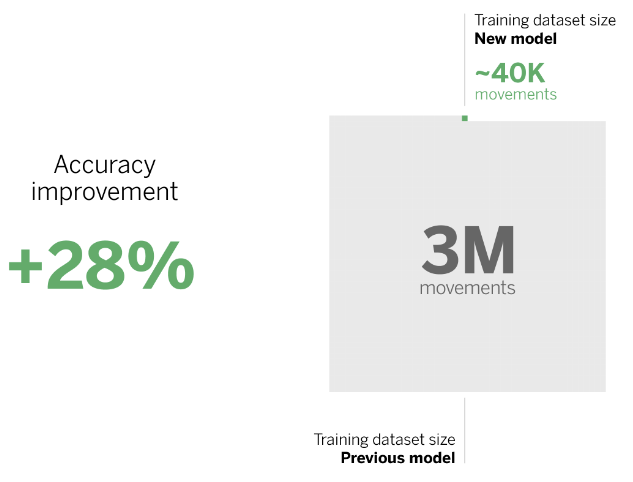

98%

reduction in required number of labeled training transactions

28%

improvement in ML model accuracy (with no change in existing modeling code)

[We used Cleanlab in] an update of one of the functionalities offered by the BBVA app: the categorization of financial transactions. These categories allow users to group their transactions to better control their income and expenses, and to understand the overall evolution of their finances. This service is available to all users in Spain, Mexico, Peru, Colombia, and Argentina.

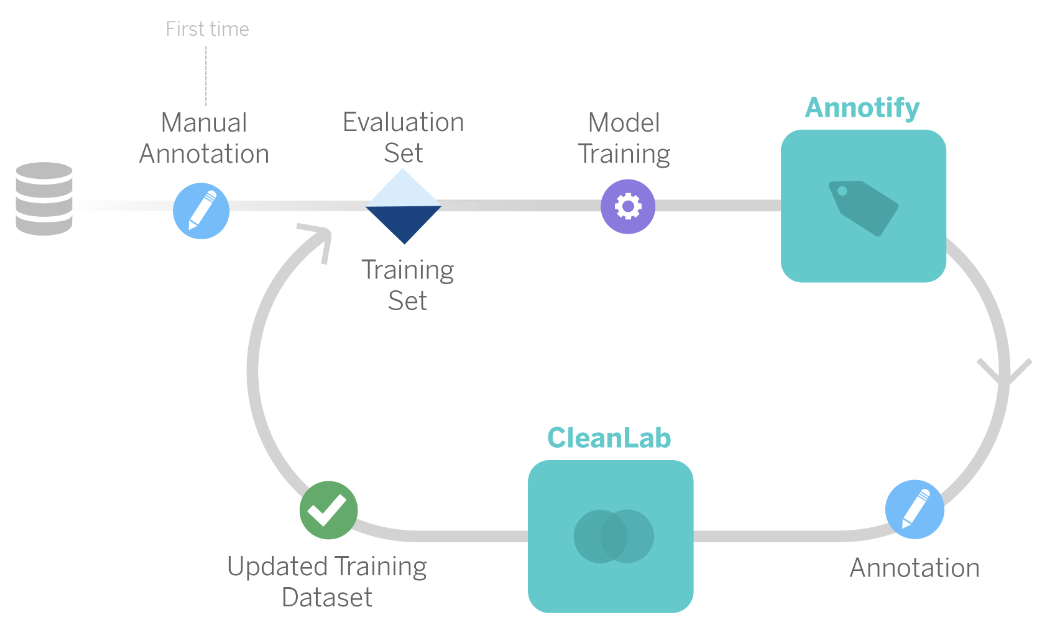

We used AL [Active Learning] in combination with Cleanlab.

This was necessary because, although we had defined and unified annotation criteria for transactions, some could be linked to several subcategories depending on the annotator’s interpretation. To reduce the impact of having different subcategories for similar transactions, we used Cleanlab for discrepancy detection.

With the current model, we were able to improve accuracy by 28%, while reducing the number of labeled transactions required to train the model by more than 98%.

CleanLab assimilates input from annotators and corrects any discrepancies between similar samples.

CleanLab helped us reduce the uncertainty of noise in the tags. This process enabled us to train the model, update the training set, and optimize its performance. The goal was to reduce the number of labeled transactions and make the model more efficient, requiring less time and dedication. This allows data scientists to focus on tasks that generate greater value for customers and organizations.

We used AL [Active Learning] in combination with Cleanlab.

This was necessary because, although we had defined and unified annotation criteria for transactions, some could be linked to several subcategories depending on the annotator’s interpretation. To reduce the impact of having different subcategories for similar transactions, we used Cleanlab for discrepancy detection.

With the current model, we were able to improve accuracy by 28%, while reducing the number of labeled transactions required to train the model by more than 98%.

CleanLab assimilates input from annotators and corrects any discrepancies between similar samples.

CleanLab helped us reduce the uncertainty of noise in the tags. This process enabled us to train the model, update the training set, and optimize its performance. The goal was to reduce the number of labeled transactions and make the model more efficient, requiring less time and dedication. This allows data scientists to focus on tasks that generate greater value for customers and organizations.

BBVA is one of the largest financial institutions in the world. With a strong presence in multiple countries, BBVA offers a wide array of banking and financial services to individuals, businesses, and institutions.

Case StudyWells Fargo

Wells Fargo used Cleanlab to train accurate (F1 score = 80%) ML classifiers on financial data with 40% label noise.

80%

F1 Score achieved after utilizing Cleanlab

40%

Label noise present in training data

We used cleanlab for finding label errors in financial text data, helping us find label errors in our human annotation process. I like cleanlab more than alternative solutions because it's like 'bring your own model' & 'bring your own data', by acting like a wrapper around your model, it's superbly easy to implement, and it works well even when the model itself is not decent in classification due to relatively high noise rate (40% noisy) to achieve a consistent f1 score around 80%.

Wells Fargo is a trusted financial services company with over 150 years of history offering banking, investment, and consumer and commercial finance solutions, serving millions of customers across the United States.

Case StudyCustomer Requests at Online Bank

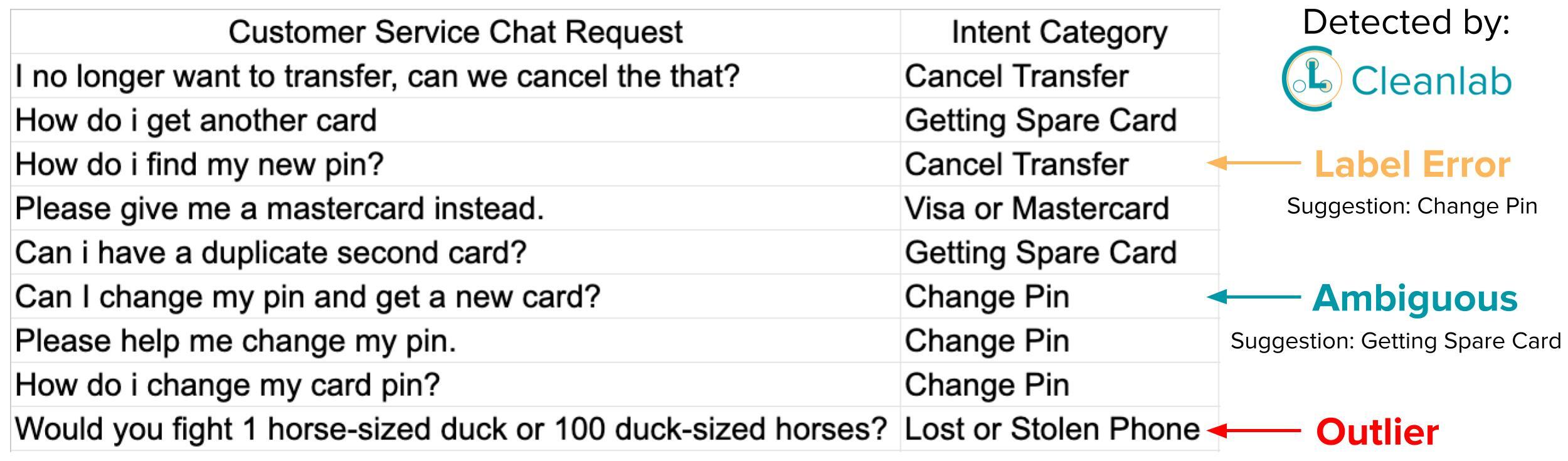

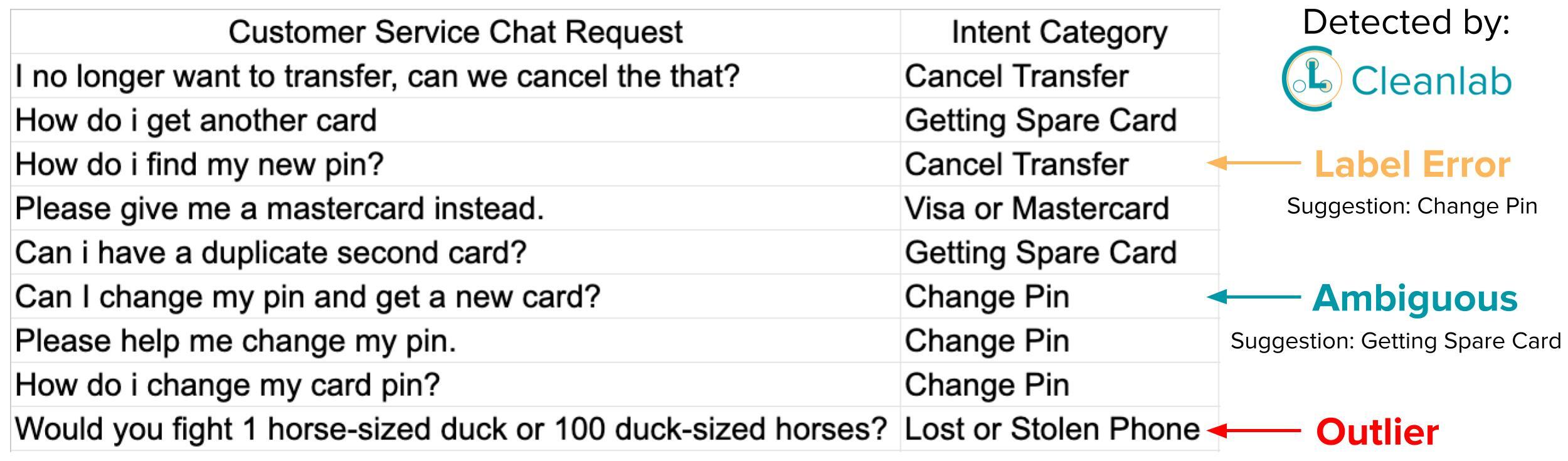

To automatically triage future customer requests, intent classification is a standard Machine Learning task in customer service applications that requires well-labeled data. When run on a dataset of customer requests (text) annotated with 10 different intents, Cleanlab Studio found over 5% of dataset labels were incorrect and detected out-of-scope queries (outliers) like "how much is 1 share of aapl" and "is android better than iphone".

This dataset was also used for customer analytics, to determine the relative frequencies of different types of customer requests and which types are most common. However, some conclusions drawn from the original dataset are inaccurate due to the mislabeling and out-of-scope issues. Significantly more accurate conclusions were obtained by running the same analytics on the cleaned version of the dataset obtained from Cleanlab Studio.

Using Cleanlab Studio to auto-fix label issues in this dataset led to a 16% improvement in prediction error without altering the existing LLM Transformer model or training code. Addressing additional data issues further enhanced accuracy without any model changes.

Businesses striving to make better decisions for customers must rely on accurate data-driven conclusions. These in turn rely on accurate data, which for this customer service application was easy to ensure with Cleanlab Studio.

This dataset was also used for customer analytics, to determine the relative frequencies of different types of customer requests and which types are most common. However, some conclusions drawn from the original dataset are inaccurate due to the mislabeling and out-of-scope issues. Significantly more accurate conclusions were obtained by running the same analytics on the cleaned version of the dataset obtained from Cleanlab Studio.

Using Cleanlab Studio to auto-fix label issues in this dataset led to a 16% improvement in prediction error without altering the existing LLM Transformer model or training code. Addressing additional data issues further enhanced accuracy without any model changes.

Businesses striving to make better decisions for customers must rely on accurate data-driven conclusions. These in turn rely on accurate data, which for this customer service application was easy to ensure with Cleanlab Studio.

HOW CLEANLAB IMPROVES KEY FINANCIAL PROCESSES

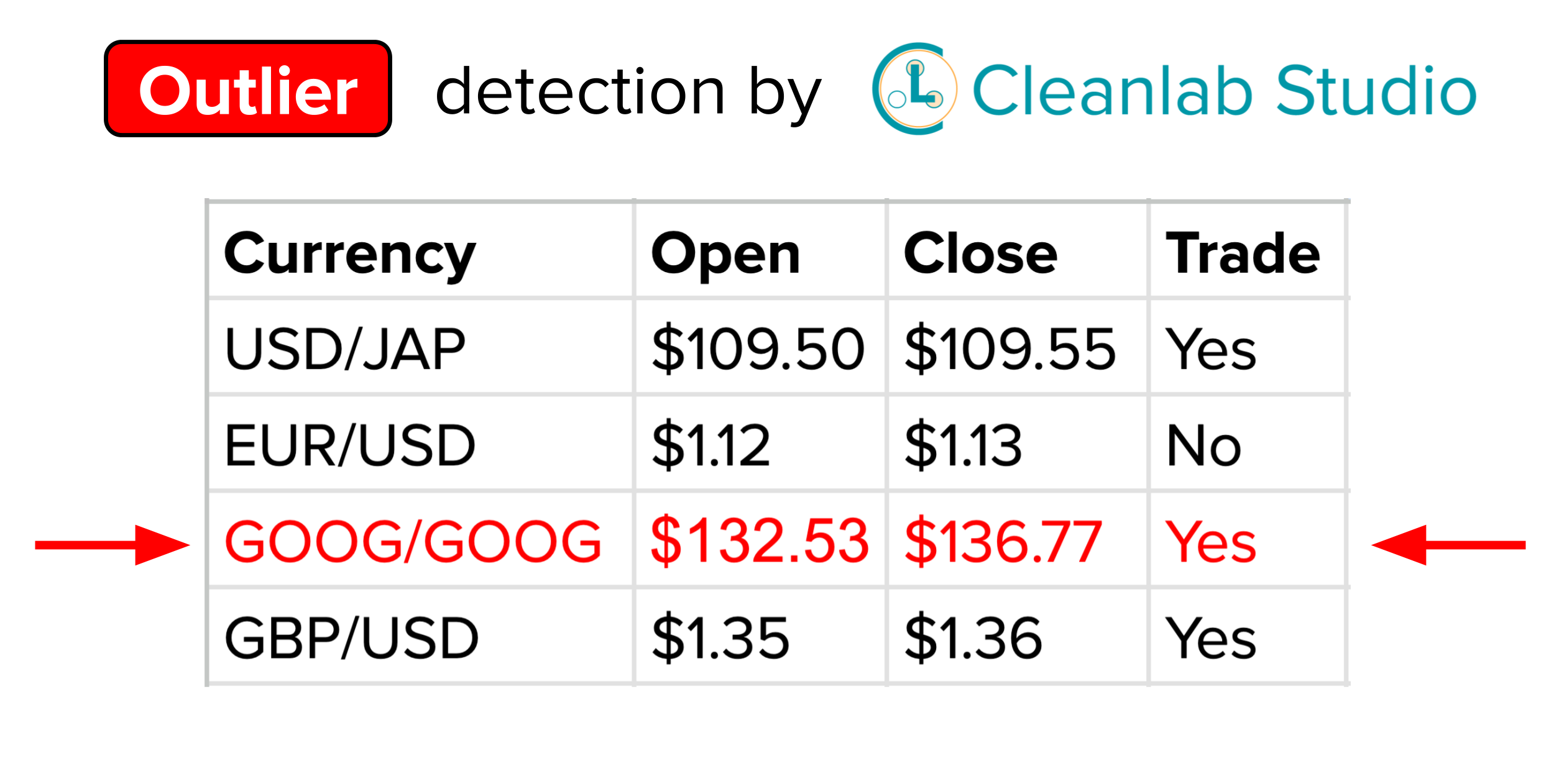

Outlier & Anomaly Detection

Use advanced AI to detect outliers in text, images, and data files (Excel, CSV, JSON). Improve modeling of transactions, money reserves, and clients/providers. Cleanlab Studio offers comprehensive anomaly diagnosis beyond basic stats and past trends. Discover more with Cleanlab:

Use advanced AI to detect outliers in text, images, and data files (Excel, CSV, JSON). Improve modeling of transactions, money reserves, and clients/providers. Cleanlab Studio offers comprehensive anomaly diagnosis beyond basic stats and past trends. Discover more with Cleanlab:

Fraud Detection

Real-world training datasets often contain significant label noise, including overlooked cases of fraud. Cleanlab algorithms automatically detect and correct instances that are mislabeled, improving the reliability of fraud detection model training and evaluation.

Real-world training datasets often contain significant label noise, including overlooked cases of fraud. Cleanlab algorithms automatically detect and correct instances that are mislabeled, improving the reliability of fraud detection model training and evaluation.

Risk Assessment

Cleanlab Studio enables data-centric AI to build accurate ML models for messy real-world tabular or text data. You can effortlessly harness AutoML for various data types, including text, image, and tabular formats (Excel, CSV, Json), allowing you to focus on the most important aspect: the data. Learn more:

Cleanlab Studio enables data-centric AI to build accurate ML models for messy real-world tabular or text data. You can effortlessly harness AutoML for various data types, including text, image, and tabular formats (Excel, CSV, Json), allowing you to focus on the most important aspect: the data. Learn more:

Aggregating Decisions/Predictions from Multiple Analysts

Cleanlab can analyze data annotated with multiple individuals’ decisions and estimate:

Cleanlab can analyze data annotated with multiple individuals’ decisions and estimate:

- A consensus decision for each instance that aggregates the individual decisions.

- A quality score for each consensus decision to gauge confidence that it is the correct choice.

- A quality score for each annotator to quantify their overall skills.

Data Auditing to ensure Compliance

Videos on using Cleanlab Studio to automatically detect errors in:

Videos on using Cleanlab Studio to automatically detect errors in:

Related applications

Data Entry, Management, and Curation

AI expert review of your data stores to find errors or incorrect labels.

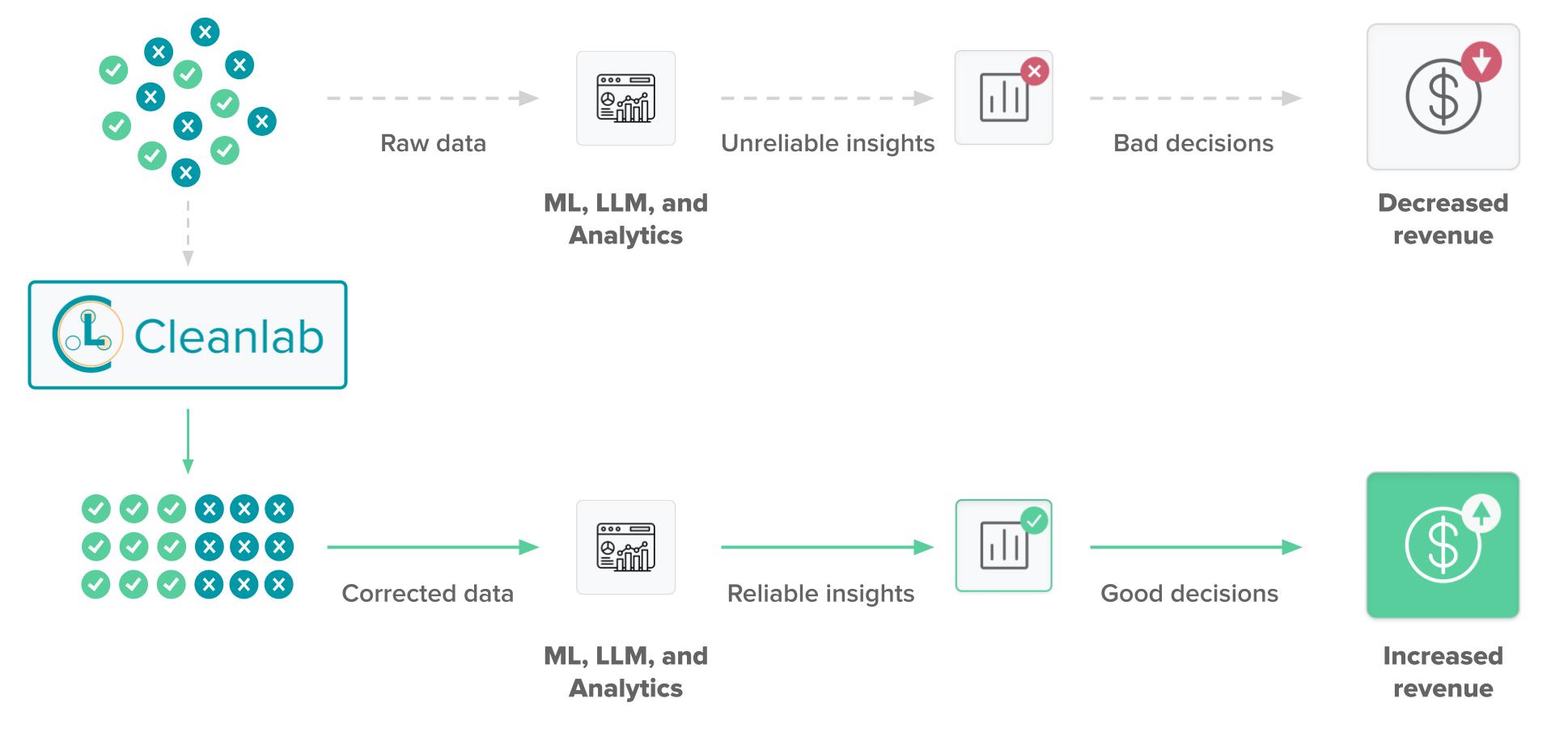

Business Intelligence / Analytics

Correct data errors for more accurate analytics/modeling enabling better decisions.

Customer Service

Fix common issues in customer data, and deploy robust ML models to better understand customers and handle their requests.

Foundation and Large Language Models

Boost fine-tuning accuracy and reduce time spent

Data Annotation & Crowdsourcing

Label data efficiently and accurately, understand annotator quality.

Cleanlab Studio auto-corrects raw data to ensure reliable analytics so you can make good financial decisions.